Entry Date: 27 DEC 2025, 1:04 PM

By: PIB Delhi

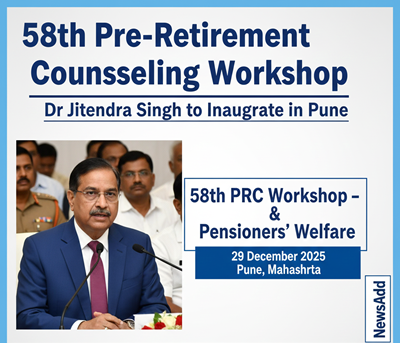

Dr. Jitendra Singh, Union Minister of State (Independent Charge) for the Prime Minister’s Office, Personnel, Public Grievances and Pensions, will inaugurate the 58th Pre-Retirement Counselling (PRC) Workshop and Awareness Programmes for Central Government employees and bankers/pensioners on 29 December 2025 in Pune, Maharashtra. On the occasion, the Minister will also inaugurate an exhibition by Pension Disbursing Banks.

In line with the Hon’ble Prime Minister’s vision of “Ease of Living” for pensioners and family pensioners, the Department of Pension & Pensioners’ Welfare (DoPPW) has undertaken several progressive reforms in pension policy and digitisation of pension-related processes. As part of these continuous efforts, the Department is organising the 58th Pre-Retirement Counselling Workshop in Pune.

The workshop is a landmark initiative aimed at facilitating a smooth transition for Central Government employees approaching retirement. Various informative sessions will be conducted on key topics such as retirement benefits, Central Government Health Scheme (CGHS), investment options, Bhavishya Portal, Integrated Pensioners’ Portal, family pension, CPENGRAMS, Anubhav portal, and Digital Life Certificate, among others.

It is expected that around 350 Central Government employees, currently posted in Maharashtra and due to retire within the next 12 months, will significantly benefit from this Pre-Retirement Counselling Workshop. In addition to the PRC, the Department will also organise Pensioners’ Awareness Programmes for retired personnel and the 11th Bankers’ Awareness Programme for Pension Disbursing Banks.

The objective of these workshops is to enhance awareness among pensioners and pension disbursing banks about relevant rules, procedures, and best practices related to pension disbursement.

During the 58th PRC Workshop, an exhibition by Pension Disbursing Banks will be organised with active participation from several banks. Participants will be provided with access to all pension-related banking services. Banks will also guide retiring employees on opening pension accounts and investing pension funds in schemes suited to their individual needs.